Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, Soojosie.

We have two ways to correct a submitted pay run to the ATO, which depend on whether a superannuation payment has already been processed.

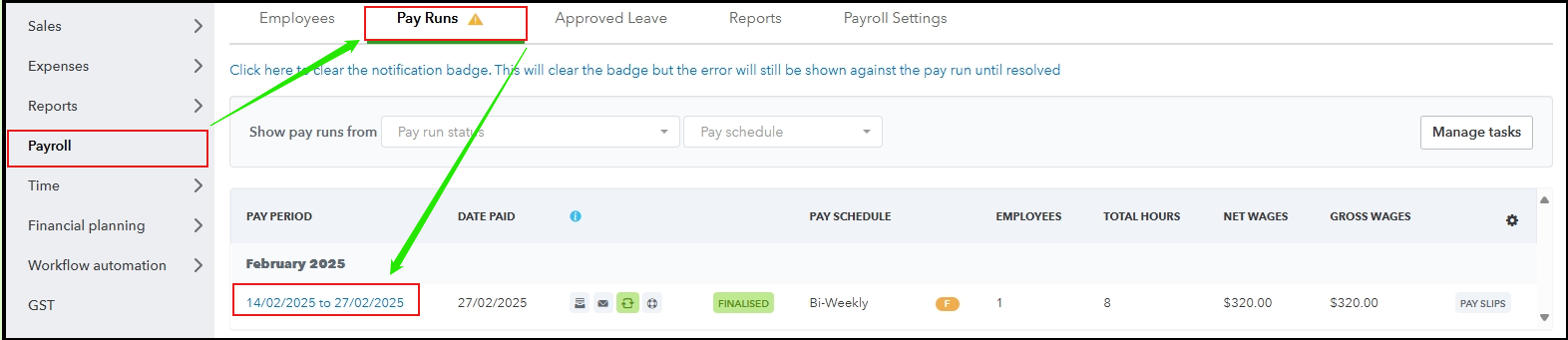

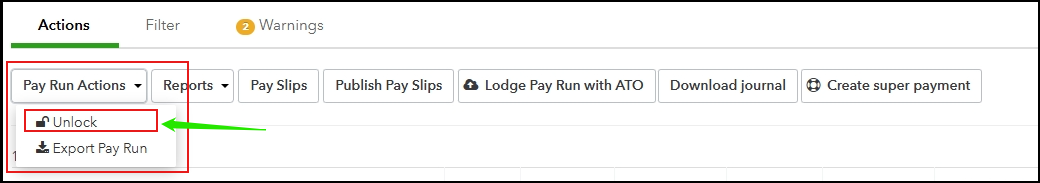

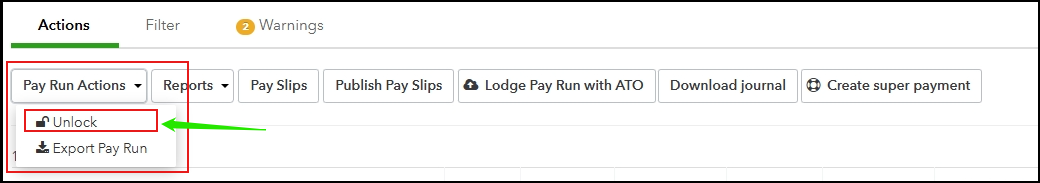

If a superannuation payment has not been processed. We can unlock and finalize the pay run again. Here's how to do it:

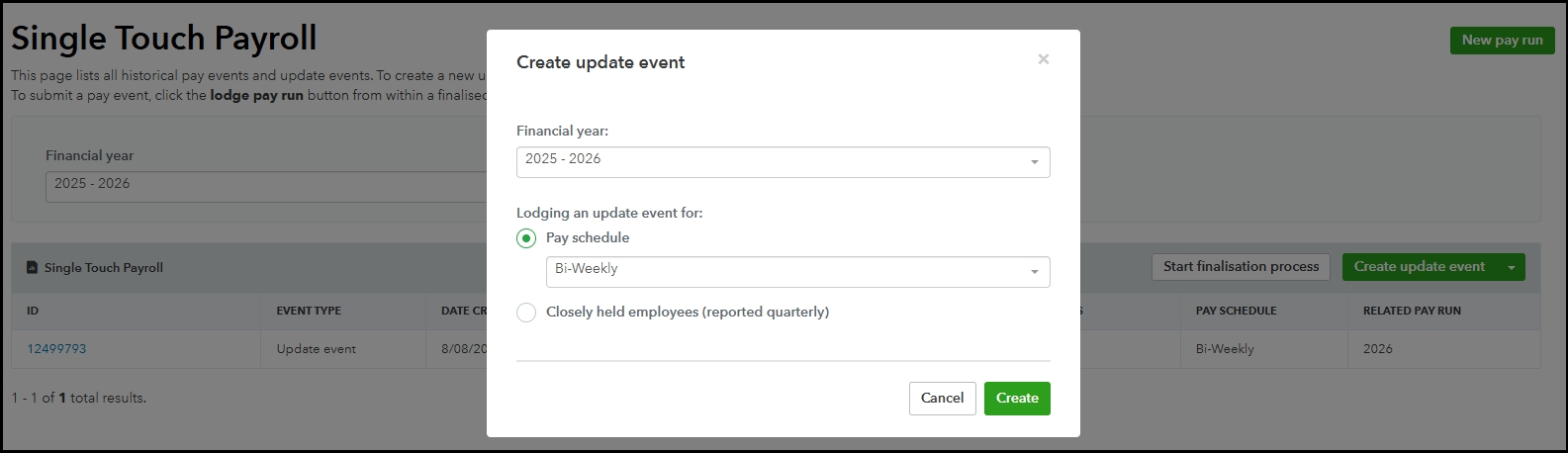

If a super payment has already been processed, you cannot unlock the original pay run. Instead, we will create an ad hoc pay run for the corrections, then lodge an update event with the ATO:

For more information, refer to the link: Create and lodge an update event in QuickBooks Online.

If you have any further questions or require additional assistance, please add a comment below. We are here to help.