- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

How to set up TDS

TDS (Tax Deducted at Source) is enabled at the customer and supplier level.

Enable TDS for Customers

To enable TDS for customers, while creating a new customer, enter customer's PAN number and select the box TDS Applicable, which is available under Tax info tab. For enabling TDS for already existing customers, follow the steps below:

- Go to Sales.

- Select Customers at the top.

- Select the name of the customer for whom you want to enable TDS and select Edit.

- In the customer information pop-up, select the Tax info tab and enter the PAN number and select the TDS Applicable checkbox.

- Select Save.

Once TDS is enabled for a particular customer, while creating the invoice for that customer, you will get option to select TDS section and enter the TDS amount applicable in that invoice.

Enable TDS for Suppliers

To enable TDS for suppliers, while creating a new supplier, enter the PAN number of the supplier and select the box TDS Applicable. Once you select TDS Applicable, you'll have the option to select Entity Type and default TDS section applicable for the supplier. Please select relevant options. TDS will be calculated for the supplier according to the threshold prescribed under the selected section during entry of a Bill or Expense. However, if you want to override the threshold and enter the TDS amount manually, please select the checkbox, which reads Override Calculation Threshold.

For enabling TDS for already existing supplier, follow the steps below:

- Go to Expenses.

- Select Suppliers at the top.

- Select the supplier name for whom you want to enable TDS and select Edit.

- In the supplier information pop-up, enter the PAN number and select the TDS Applicable checkbox.

- Once you select the TDS Applicable checkbox, you'll have the option to select Entity Type and default TDS section applicable to the supplier. Please select relevant options. TDS will be calculated for the supplier according to the threshold prescribed under the selected section during entry of a Bill or Expense. However, if you want to override the threshold and enter the TDS amount manually, please select the checkbox, which reads Override Calculation Threshold.

- Select Save.

Once TDS is enabled for a particular supplier, while entering the bill for that supplier, you will get option to automatically calculate TDS based on the selected section.

Note : TDS Calculation is possible only for Bills & Expense transactions dated on or after 1st of April 2014. For transactions prior to 1st April 2014 please calculate the TDS manually and enter.

How the TDS is calculated in QuickBooks Online? What is the threshold?

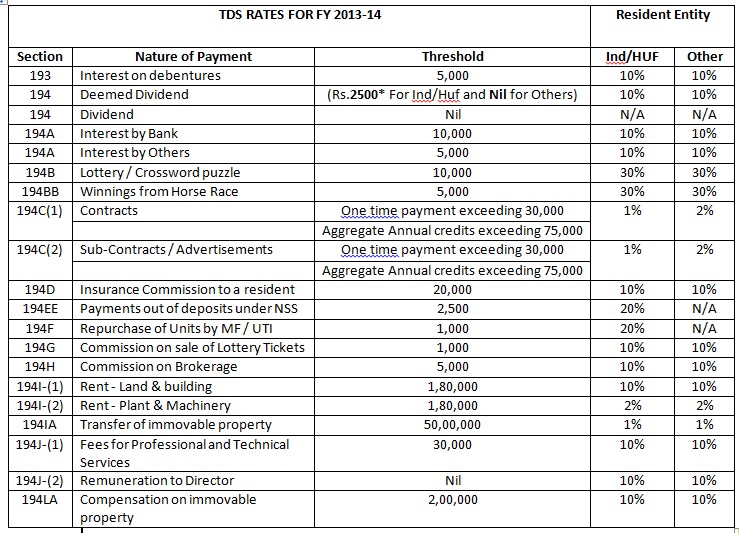

QuickBooks Online calculates TDS based on the threshold defined under various provisions of the Indian Income Tax Act. Following is the list of TDS Provisions (sections), which are available in QuickBooks Online for TDS calculation. The TDS chart below shows the TDS rates applicable to Resident assessees from Previous year April 1, 2013 with relevant Assessment Year 2014-15. It may be noted that the TDS Chart contains extracts of provisions from accounting perspective and does not in any way be treated or interpreted as a statement of law:

What types of TDS reports are available in QuickBooks?

QuickBooks Online provides TDS Payable Report, which will help you determine the amount you need to pay to Income Tax Department and prepare return.

- You can access the TDS Payable Report under Reports > All Reports > Accounting Report > TDS Payable Report.

- You can access the TDS Receivable Report under Chart of Accounts > select TDS Receivable > select Report.

What happens if I delete an Invoice or Bill which had TDS entry?

When you delete an Invoice or Bill, which has TDS entry, the TDS entry also gets deleted along with the invoice/bill.