- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Reclassifying some employees to COGS and administrative employees to expenses

I would like to move my help desk techs to COGS but keep my administrative team in expenses. I use quickbooks online and run the payroll myself. How do I reclassify only some employees?

Solved! Go to Solution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Welcome to the Community, dsmith3.

I'd be happy to help you reclassify your employees' payroll settings. Just follow these easy steps:

Edit Payroll Settings

- Click the Gear icon.

- Choose Payroll Settings.

- Select Accounting in the Preferences section

- In the Wage Expense Accounts section, select I use different accounts for different groups of employees.

- Choose the appropriate account (COGS) from the Wage Account drop-down menu for each employee.

- Scroll down and click OK.

- You'll be routed to the Account Preferences Summary page. In here, you're given the chance to update the existing transactions of your employees. Just enter the correct Starting Date, then click Update.

- Hit OK once the update is complete.

Before you go, please be sure to reach out to an accounting consultant to ensure this method is the best suit for your business. With Intuit's Find-A-ProAdvisor site, you can search for certified professionals in proximity to your ZIP code that can discuss options more personal to your business's needs.

Be sure to let me know if there's anything else I can do to help you succeed with QuickBooks. Thanks for reaching out, wishing you and your business continued success.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

How do I get to payroll settings in quickbooks desktop to choose to break out my employees by different categories? I also have enhanced payroll if that matters. I went to payroll set- up and payroll preferences and don't see it. I don't see an option to select that I Use different accounts for different groups of employees. TIA

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Hi @bgoodrud,

For a group of employees, you’ll want to enable class tracking and add a class to your employee’s profile. Here are the steps you can follow:

- Go to the Employees menu.

- Choose Employees Center.

- Select an Employee, then select the Payroll Info tab.

- Add Class, then hit OK.

You can also add an item name under earnings if you’d like to automatically show to employee’s paycheck.

QuickBooks Desktop uses payroll items that can assign to different accounts. Here’s how:

- Select Lists at the left top and choose Payroll Item List.

- Click Payroll Item.

- Select New and hit Custom Setup.

- Enter the necessary information.

- Select the Expense account you created.

- Hit Next until you can select Finish.

You can refer to these articles for additional reference:

Leave a post below if you have other payroll-related questions or concerns. I'm always here to help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

In Enterprise 20 desktop how do I get to the payroll settings screen? I've looked in preferences under both accounting and payroll. I don't see where I can select "I use different accounts for different groups of employees" anywhere. FYI, I have advanced payroll.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I though there is a way to set it up using GL accounts so it breaks it out on the main P&L and I want to do it that way not with classes. I have classes set up differently already.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Let me help you sort this out, bgoodrud.

To use another account for your payroll transactions, you'll need to create a separate payroll item and choose the expense account from there (see sample screenshot below). You can follow the detailed steps provided by my peer above in creating a new payroll item in QuickBooks Desktop.

Additionally, you can visit these write-ups to know more about changing your bank account for QuickBooks Desktop Payroll:

Change your direct deposit bank account for QuickBooks Desktop Payroll

Change an expense or liability account associated with a payroll item

If there's anything else you need please let me know. I'd be more than willing to lend you a hand.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I'm trying to doing this as well and wasn't able to find a button that says, "Starting Date".

Currently, I adjusted my chart of accounts to reflect the direct labor and regular admin employee and it's not reflecting on my P&L. I'm using QBO. help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Let me help you edit your payroll settings, @dorisng.

You’ll not see the Starting Date button in the Account Preferences Summary page if you’ve not used that payroll item on the paychecks. Just click on the OK button at the bottom after updating all the information.

Here are some references that you can check in payroll settings:

Let me know if there's anything that I can help. I'm always here to assist.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

There is no button for start date, please provide information on how to reclassify existing payroll expenses to a new payroll expense category. I can update it going forward but see no option to change the category for existing payroll expense transactions.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Once you make the change from wage expense to COGS - does it at all impact payroll reports, such as payroll summary report? I guess I am wondering that if I change the classification - do I need to amend something on the payroll reports.

Thank you,

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Let me help you from here, Ironmikesharp.

Once you change the account to COGS, it will affect accounting reports like Profit and Loss. Although, it doesn't impact the Payroll Summary report since you're unable to see the affected accounts. That means you don't have to amend something on the payroll reports.

I'll share the article about how to run payroll reports as a future reference.

Feel free to reach out to us if you have other payroll concerns. We're just a post away.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thank you Kristine,

Lovely - I am looking to move the salaries up to COGS, so as to capture the inputs from the manufacturing and fabrication piece. Is there a way to assign certain employees to COGS and to keep some on the salary expense line?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thank you for getting back here in the thread @Ironmikesharp.

In QuickBooks, you're not able to assign your certain employees to COGS. Cost of Goods Sold tracks all of the costs associated with the items you sell, which allows you to calculate gross profits accurately. Also, give the total underlying costs on your Profit & Loss reports.

In posting your employee salary into COGS, you can create a journal entry. You can follow these steps on how:

- Go to the +New button.

- Under the Other column, select Journal Entry.

- Fill out the fields to create your journal entry. Note: I recommend contacting an accountant to seek for assistance on what account you should use.

- Click either Save and new or Save and close.

You can review the transactions you entered and print it using the journal entry report. Check out this article: Print a journal entry report.

You may also use this article for more detailed information about payroll in your QuickBooks Online account: Get started with Payroll.

Please know that I'm always around here in the Community to help. Take care, and have a good day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Good morning,

Thank you for your response. Is there a way to assign all salary to COGS as opposed to certain employees?Can you please provide direction on that and if I have to be in single user mode in order to make that change?

Thank you,

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thank you for coming back on this thread, @Ironmikesharp.

I can help walk you through the steps on how to assign all employee's salaries to COGS in QuickBooks Desktop.

Let's change the Salary Item to COGS by going to the Payroll Item List. Right-click the Salary Item, then click Edit and choose COGS in the account drop-down arrow. Please note that all employee's salaries will post to the COGS account moving forward.

Before you go, please be sure to reach out to an accounting consultant to ensure this method is the best suit for your business.

See the sample screenshot below:

For the detailed steps, please visit this article: Edit a payroll item.

You can always access different payroll reports by going to the Reports menu, then select the Employees & Payroll tab. For more information, you may check out this article: Customize reports.

Please browse through this article for your future reference: Edit payroll items used on paychecks. This link includes steps on how to change incorrect payroll items used on paychecks.

Let me know if you follow-up questions. I'm always here to help. Take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I didn't find the add class button under payroll info tab

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Hello there, Ruquia.

I'm here to help you locate the class button in QuickBooks Desktop.

Class tracking helps you track balances by department, business office, or location and separate properties. To set up and use class tracking in QuickBooks Desktop, you need to turn on the class tracking feature.

Here's how:

- Open your company file.

- Select Edit menu, then click Preferences.

- Choose Accounting, then go to the Company Preferences tab.

- Select the Use class tracking for transactions checkbox.

- If you want a reminder when you haven't assigned a class, select the Prompt to assign classes checkbox.

- Select OK

Once done, you can now add a class button in the payroll info tab.

- Open your company file.

- Go to the Edit menu, then select Preferences.

- Select Accounting, then go to the Company Preferences tab.>

- Select the Use class tracking for transactions checkbox.

- If you want a reminder when you haven't assigned a class, select the Prompt to assign classes checkbox.

- Select OK.

I'd also encourage you to visit these articles that'll help you add, edit payroll items, and create an account in QuickBooks Desktop:

Let me know if there's anything that I can help with adding a class in the payroll info tab. I'm one post away. Take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thank you so much for prompt reply . I was able to set up. I have a question that do you think for cost accounting for example for construction related company this is the best way to track payroll expenses related to different project . Do Quick book desktop have some other great function to track payroll expense on different project of the company.

Best Regards

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thank you for following-up, Ruquia.

It's good to hear that you were able to set up the class tracking in QuickBooks.

You can use this feature to classify your income and expenses by department, business office or location, separate properties you own, or any other meaningful breakdown of the business you do.

You can generate a payroll summary report that can be broken down by class. Let me show you how:

- Inside QuickBooks, go to Reports menu.

- Choose Employees & Payroll Reports.

- Select Payroll Summary.

- Click on Customize Report on the report button bar.

- From the Column drop-down list, select Class.

- Make any other changes to the report. Then select OK.

I've added this article to learn more on how to track payroll expense using class tracking: Tracking payroll expenses by class, department, or location.

You can also check out this article on how to filter, sort or total reports by class.

Post your concerns or click the reply button for any follow-up questions about class tracking. I'll be here to answer them. Have a great week!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I'm trying to assign different employees wages to different expense accounts. I have gone to payroll settings-accounting preferences - 1. Where do you track employee wages in your QuickBooks chart of accounts?

but when I try to update using the "

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Help has arrived to ensure your Each employee's wages are posted to different types of accounts (ex: salary, contractor, and so on) option will get working, @BartBy.

Cached data might be the reason behind this. Sometimes they become outdated or corrupted, leading to unusual behavior that affects system functionalities. You can perform some troubleshooting steps to get this resolved.

First, open your QuickBooks Online account in a private or incognito window for testing. You can use these shortcuts keys below for quick navigation:

- Google Chrome: Ctrl + Shift + N

- Safari 11 or newer: ⌘ + Shift + N

- Mozilla Firefox: Ctrl + Shift + P

- Microsoft Edge: Ctrl + Shift + P

Once logged in, redo the process. If you can proceed after clicking Continue, get back to your regular browser and clear its cache. Doing this helps the program to run better. You can also use other supported browsers as an alternative except for Internet Explorer.

If you want to track reimbursements separately for different expense types, just visit this article for complete instructions: Create a reimbursement pay type in Online Payroll.

Please don’t hesitate to tap the Reply button below if you have any other questions or concerns about payroll. We’ll be here to help. Always take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thanks for the response. I wasn't able to make the change after clearing the cache. I tried incognito windows in both firefox and chrome and cleared the cache to no avail. I am able to change the primary wage account and able to change the reimbursement account but I can't make the change to multiple wage accounts. Thanks in advance for any ideas.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

I appreciate you getting back to us with your results, BartBy.

The steps recommended and you performed are the common fix issues with the option "Each employee's wages are posted to different types of accounts (ex: salary, contractor, and so on)".

Since you're still having trouble achieving this goal, I suggest contacting our QuickBooks Care Team. This should be handle in a secure environment so our technical support can further investigate this behavior.

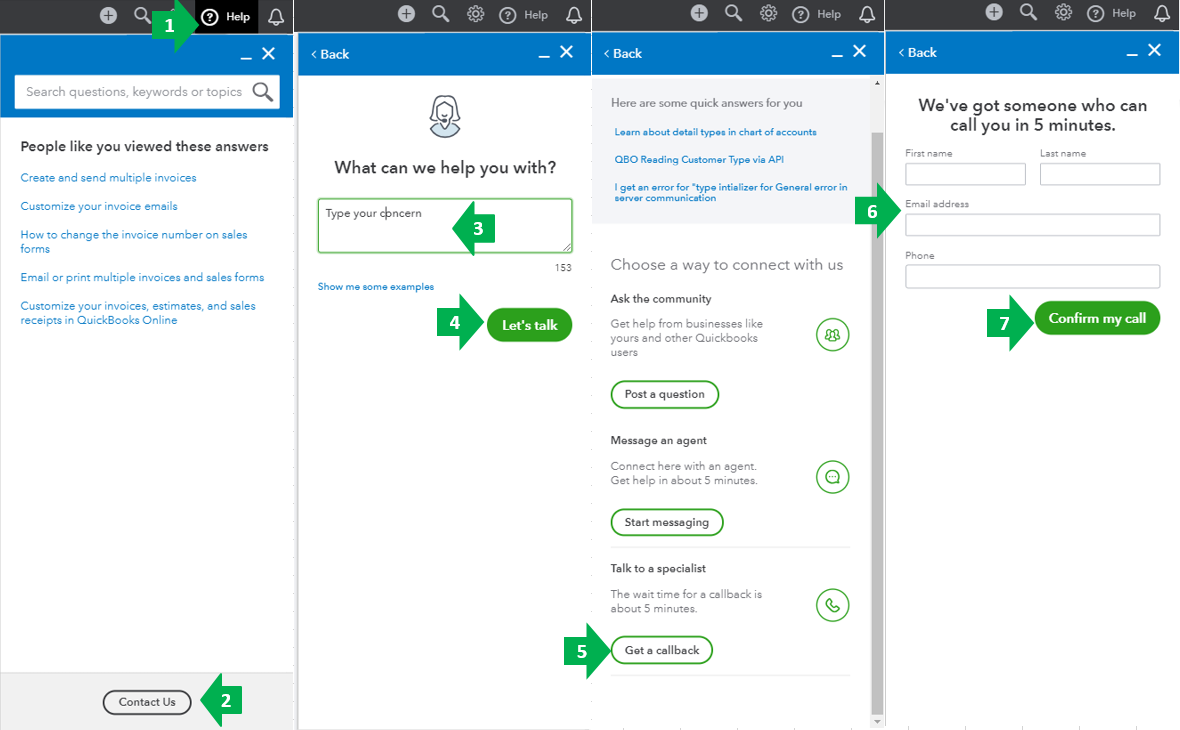

Here's how:

- Go to the Help menu at the upper right.

- Select Contact Us.

- Enter your concern.

- Click Let’s talk.

- Choose Get a callback.

- Type in your contact info.

- Select Confirm my call.

You can check out this article for our most updated contact information: Support hours and types.

Also, let me share these easy-to-access articles, webinars, and video tutorials that will help you in familiarizing the different tasks, features, and functions of QBO. Below are the following:

Anything else you need help with can be answered in the Community. Feel free to visit us again for more questions. Stay safe and have a good one.