- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Adding DBA 1099 NEC 2nd line in QBO

How do I add 20d line for DBA in QBO

Thank you,

Rhonda

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Adding DBA in QuickBooks Online is just a few clicks, @AccountableAZ.

Thanks for dropping by the Community. I have here the steps that can help you add the DBA for the Form 1099-NEC.

Here’s how:

- Select the Payroll menu, then choose Contractors.

- Click the name of the contractor.

- Enter the DBA under the Business name.

- Fill in the necessary fields.

- Press Save.

You can check this article for reference on how to prepare and file your Federal 1099s with QuickBooks Online. It helps you organize your contractors and their payments, so your filings are correct.

For further details about 1099-NEC, feel free to visit the IRS article. It contains the complete set of instructions and the latest information about the form.

If you have any questions about this, let me know in the comment. I'm here to help at any time. Have a great rest.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Thank you for your response

I wanted both the contactor name and DBA to print

Example

Joe Smith

ABC Lumber

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Thanks for the quick reply, @AccountableAZ.

I'll ensure the two contractor pieces of information will print in the 1099 Nec In QuickBooks Online.

You can add both Joe Smith and ABC Lumber in the Business name section. That way, both information will print in the 1099 NEC.

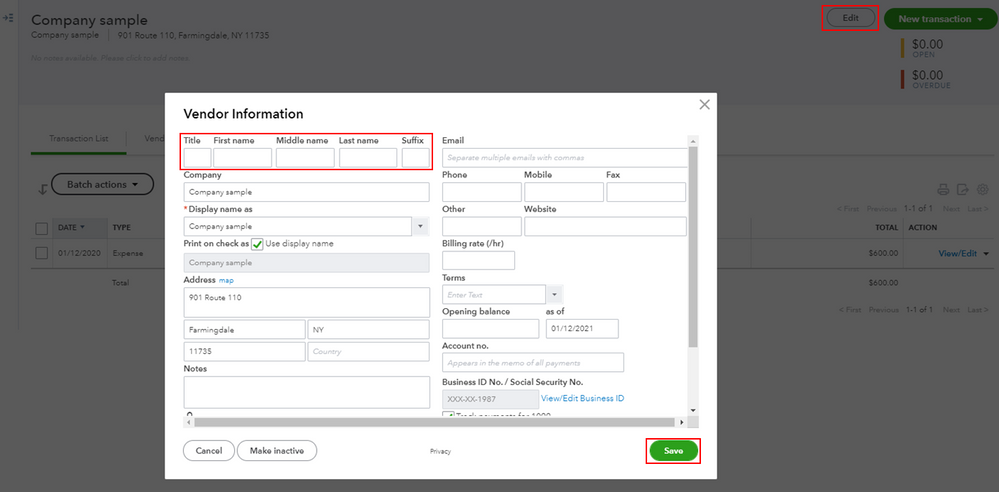

See the sample screenshot below for your reference:

Please note that there are many changes to the 1099 forms and boxes in 2021 for the tax year 2020, so make sure to choose the exact listing. For more details, check out this article: Understanding payment categories for the 1099-MISC and 1099-NEC.

I've attached articles on how to check the exclude payments, modify the chart of accounts for 1099 filing, and other topics.

- What payments are excluded from a 1099-NEC and 1099-MISC?

- How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing

- Troubleshoot common 1099 issues

Don't hesitate to leave a comment if you have an additional question. I'm glad to help. Keep safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

I will give that a shot

thank you

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hey there, @AccountableAZ.

I appreciate you taking the time to try the steps provided by my colleague above. Let us know how it works for you.

Please do let us know if you have further questions or concerns. You can always reach out to the Community anytime you need a helping hand. Have a wonderful weekend!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hello:)

I tried adding a slash and entering in the business name after the contractor name, and it shows up on the 1099-NEC as a slash after the name. I want it to appear as it did on the 1099-Misc which would be directly underneath the contractor name.

Any other suggestions?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Hello there, ClearvueO.

I can see how good it is to show up the business name under the contractor name. However, including the business name next to the contractor appears on the 1099-Misc the same way you enter it in the program. This is the format used in QuickBooks.

You can always visit our QuickBooks Blog for our latest news, updates, and innovations.

Let me know if you have other questions. Always take care and stay healthy.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

This doesn't work if it's an individual with a social security number with a DBA. As soon as I check individual the business name field disappears. If I check business and try to enter the Employer Identification number in social security format I can't save.

I've also tried going to the edit vendor screen inputting the first and last name, company name and social security number. All the information appears in the review 1099 screen, but the company name does not print on the 1099.

How do you get a name, a company name and a social security number to print on a 1099-NEC?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Thanks for informing us about the steps you've performed, kellyjackson. I know it can be challenging when you can't add all the necessary details in your 1099 form. I'm here to help you with that.

Printing the vendor's name, company name, and social security number on the 1099-NEC is unavailable. The form only considers one recipient's name. Thus, when you enter the vendor's name on their profile, the system will automatically read and print it as the company name.

For now, you can consider removing the vendor name to show the company name on the 1099-NEC form. Then, reenter it once done preparing and filing the form. Here's how:

- Go to the Vendors menu, then select each vendor that isn't showing the company name.

- Click the Edit button.

- Remove the name of the vendor, then click Save.

Once done, prepare your 1099-NEC again and verify if the company name is already showing. After preparing the form, you can reenter the vendor's name on their profile.

If the issue persists, I'd recommend contacting our QuickBooks Support Team. This way, they can further investigate this matter and provide additional troubleshooting steps to get this resolved.

Additionally, I've included an article that'll help you learn more about the boxes on Forms 1099-NEC and 1099-MISC. This ensures your form is accurate: Understand Payment Categories.

You can count on me if you have more questions about managing your 1099 forms, kellyjackson. It's always my priority to help you out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Account management

Just FYI the IRS will send a CP2100 notice if you prepare a 1099 with a company name and a social security number. The individual's name must be on the first line. I'm including a screen shot from the IRS instructions. QuickBooks really should fix this problem.