Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, Aaron.

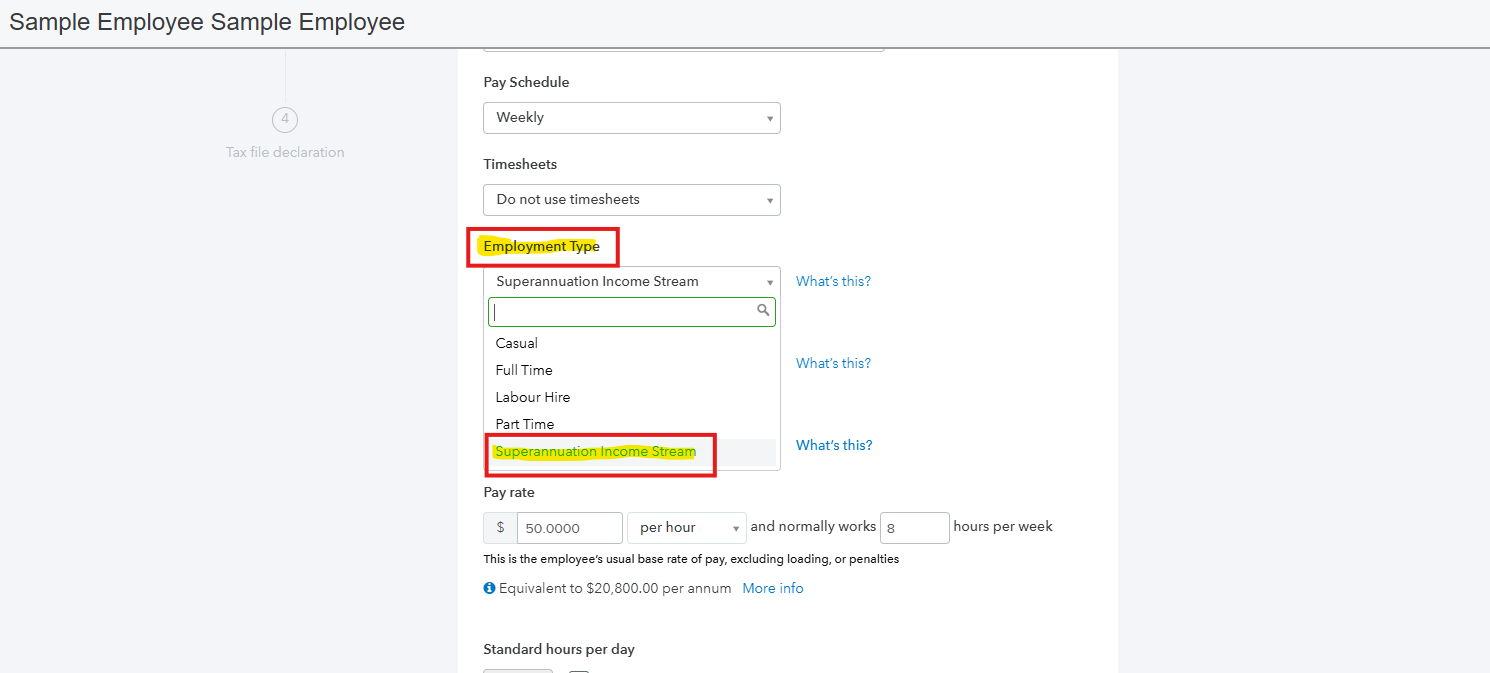

In QuickBooks, we can add your Subcontractor as an employee with the employment type of Superannuation Income Stream. Here's how:

The STP tax category for the payee must be set as ATO-defined> Non-employee. You can set this up under Tax File Declaration after you complete the employment details by selecting Next.

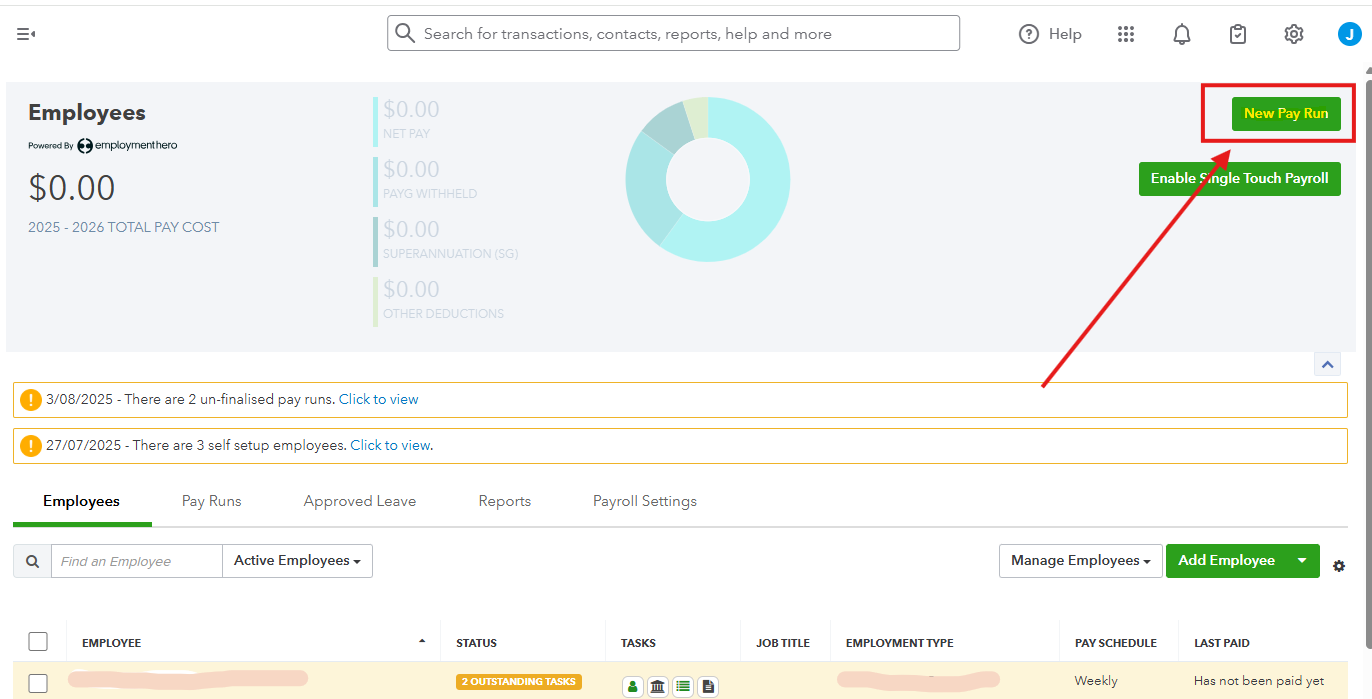

After that, you can create a New Pay Run for your Subcontractor in the upper right corner. See screenshot below.

After creating a pay run for this Subcontractor, you'll be able to create a super batch payment for them. For more detailed information, refer to this article: Setting up Super Payments with Beam in QuickBooks Online.

If you have any other questions, let us know in the comments below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here