Hi there, @veeshy.

Glad you joined us here! Let me guide you on how to move past your issue with your VAT return.

You'll want to double-check that you've added the VAT to the invoices for the other two months. You can run the Transaction List by Date report and customise this report to show invoices with missing VAT. Then, update your invoices to get accurate records for accounting and tax purposes.

Here's how:

- Go to the Reports menu.

- In the search field, enter Transaction List by Date. Then, select it.

- Click Customise.

- From the Report period dropdown, choose the correct date range.

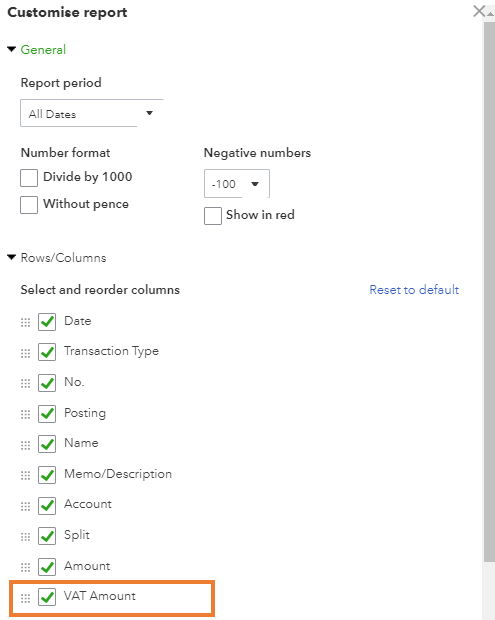

- From the Rows/Columns dropdown, click Change columns.

- Select VAT Amount.

- Click Run Report.

- Select each invoice that has no VAT.

- Add the VAT and select Save.

You may also utilize the VAT error checker to help you to stay on top of your VAT return and prevent common mistakes that could affect your VAT return.

Keep in touch if you have any clarifications or other tax concerns. I’m always glad to answer them for you. Wishing you and your business continued success.